car sales tax in austin texas

The Austin sales tax rate is. How much is sales tax in Texas on a car.

1111 W 9th St Austin Tx 1 Bath House Exterior Austin Real Estate Austin Homes

Texas has recent rate changes Thu Jul 01 2021.

. Shop Our Inventory View Our Current Specials Or Schedule A Service Appointment Online. Texas has a 625 statewide sales tax rate but also has 982 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1681 on top of the state tax. Sales tax on a car purchase in Texas is 625 regardless of where you buy it.

Travis County Tax Office Website The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County. However there may be an extra local or county sales tax added onto the base 625 state tax. The Texas sales tax rate is currently.

Ad We Dont Just Sell Cars We Go A Step Further To Get You The Most Out Of Your Vehicle. Home Used Trucks in Austin TX. A transfer of a motor vehicle without payment of consideration that does not qualify as a gift is a retail sale and is subject to the 625 percent motor vehicle tax.

A motor vehicle sale includes installment and credit sales and exchanges for property services or money. The state sales tax rate in Texas is 6250. Each of these cities charges an additional 2 county sales tax for a total tax on car purchases of 825.

Austin in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in Austin totaling 2. Texas collects a 625 state sales tax rate on the purchase of all vehicles. If sales tax was paid in another state the vehicle owner will get credit for the sales tax.

For example if your sales tax amounted to 100 you would owe 625 of that in use tax ie. Motor vehicle sales tax is due on each retail sale of a motor vehicle in Texas. The use tax rate for the sale of a car in Texas is currently 625 of the price of the car for the 2023 calendar year.

There is no applicable county tax. The Austin Sales Tax is collected by the merchant on all qualifying sales made within Austin. For vehicles that are being rented or leased see see taxation of leases and rentals.

Local tax rates range from 0 to 2 with an average of 1647. The average cumulative sales tax rate in Austin Texas is 825. 500 X 06 30 which is.

You can find more tax rates and allowances for Austin and Texas in the 2022 Texas Tax Tables. The sales tax rate does not vary based on zip code. Select the Texas city from the list of popular cities below to see its current sales tax rate.

This is the total of state county and city sales tax rates. The average sales tax rate in Texas is about 7928. Some dealerships may charge a documentary fee of 125 dollars In addition to taxes car purchases in Texas may be subject to other fees like registration title and plate fees.

The sales tax for cars in Texas is 625 of the. The minimum combined 2022 sales tax rate for Austin Texas is. The Austin Texas Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Austin Texas in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Austin Texas.

Use the following to determine how much is owed. CityCountyother sales tax authorities do not apply. Within Austin there are around 72 zip codes with the most populous zip code being 78745.

The latest sales tax rate for Austin TX. 625 percent of gross receipts. There is a 625 sales tax on the sale of vehicles in Texas.

If you would like a copy of the completed paperwork enclose a note and return label from. The max combined sales tax you can expect to pay in Texas is 825. 4 rows Austin TX Sales Tax Rate.

According to the Texas Department of Motor Vehicles any person that buys a car in Texas owes the government a motor vehicle sales tax. There are a few counties that charge no additional taxes beyond the 625 state sales tax including King County and Borden County. The County sales tax rate is.

Imagine that your monthly lease payment is 500 and your states sales tax on a leased car is 6. With local taxes the total sales tax rate is between 6250 and 8250. Ad Experience fast easy and transparent car buying.

This means that depending on your location within Texas the total tax you pay can be significantly higher than the 625 state sales tax. The current total local sales tax rate in Austin TX is 8250. What is the sales tax rate in Austin TX.

A used car in Texas will cost 90 to 95 for title and license plus 625 sales tax of the purchase price. Sales tax for a leased vehicle is calculated based on the states tax percentage and the cost of the lease payments. The 825 sales tax rate in Austin consists of 625 Texas state sales tax 100 Austin tax and 100 Special tax.

This includes the rates on the state county city and special levels. Texas collects a 625 state sales tax rate on the purchase of all vehicles. Well go at your speed when you purchase a car with Enterprise.

Austin TX 78714- 9326. Austin has parts of it located within Travis County and Williamson County. See how it works.

Calculating Texas Sales Tax Texas residents are required to pay 625 sales tax to the state of Texas when purchasing a vehicle. Texas sales tax revenue of 286 billion in July represents a 43 increase. Take your time or go fast.

Texas Sales Tax on Car Purchases. Accounting for 57 of all tax collections. Again this is subject to change year to year.

Sell Or Trade A Car. The Austin Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Austin local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc.

Bonillas Auto Sales Used Car 512 928 0446 Austin Used Cars For Sale

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

2022 Cost Of Living In Austin Texas Bankrate

Ranch Road Asphalt Paving In Austin Texas Texan Paving Road Construction Parking Lot Striping Asphalt

Down Under Auto Sales Homepage Used Car Dealership Austin Tx Homepage

Texas Sales Tax Guide And Calculator 2022 Taxjar

Http Uptownrealtyaustin Com West Campus Condo Sales Uptown Realty Austin 2309 Rio Grande St Austin Tx 78705 512 651 0505 West Campus Campus Infographic

Sales Tax On Cars And Vehicles In Texas

Why Austin Texas Wants To Be An Autos City Yes Austin Best Hotels In Austin Downtown Austin Austin 6th Street

5201 Tortuga Trl Austin Tx 0 Beds 0 5 Bath Zillow House Styles Texas Homes

2211 Canterbury St Austin Tx 4 Beds 3 Baths Living Dining Combo Home Values Canterbury

Coffee Folk Fort Worth Tx Liizisa Coffee Shop Coffee House Small Cafe

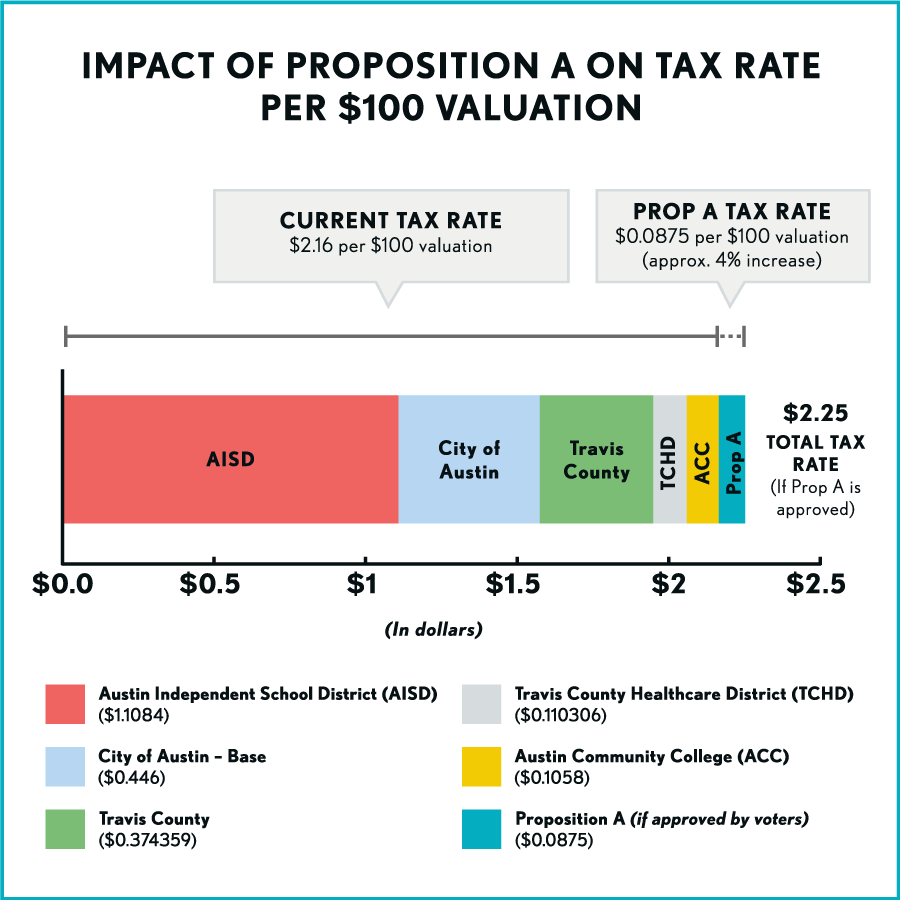

2020 Mobility Elections Proposition A Austintexas Gov

5000 Westview Dr Austin Tx 4 Beds 3 Baths Built In Ovens Home Goods Family Room

Image Result For Art For Car Wars Big Car War Big Guns

Texas Dealer Temporary Tags Template Tag Template License Plate Template Printable